- Time:2025/7/21 posted:Kehong Enterprises Co.,Ltd.

As a key protective material in the industrial field, heat shrink tubing presents multidimensional growth momentum and structural opportunities in its market application and prospects. The following analysis will be conducted from the aspects of core application scenarios, market size, competitive landscape, technology trends, and future prospects:

一、 Core application areas and market demand driven

1. Electricity and energy infrastructure

The power industry is the largest application market for heat shrink tubing, accounting for about 45%. With the transformation of smart grids, the promotion of ultra-high voltage transmission projects (expected to exceed 2 trillion yuan in ultra-high voltage investment by 2030), and the updating of old equipment, the demand for insulation protection of high-voltage cables, substation busbar connections, and other scenarios continues to grow. At the same time, the rapid expansion of renewable energy installations such as photovoltaics and wind power (such as China's 2025 target of over 100GW of new photovoltaic installations) further drives the demand for cable protection materials. For example, the demand for weather resistant and flame-retardant heat shrink tubing has significantly increased in scenarios such as wind turbine blade harness protection and internal connections of photovoltaic inverters.

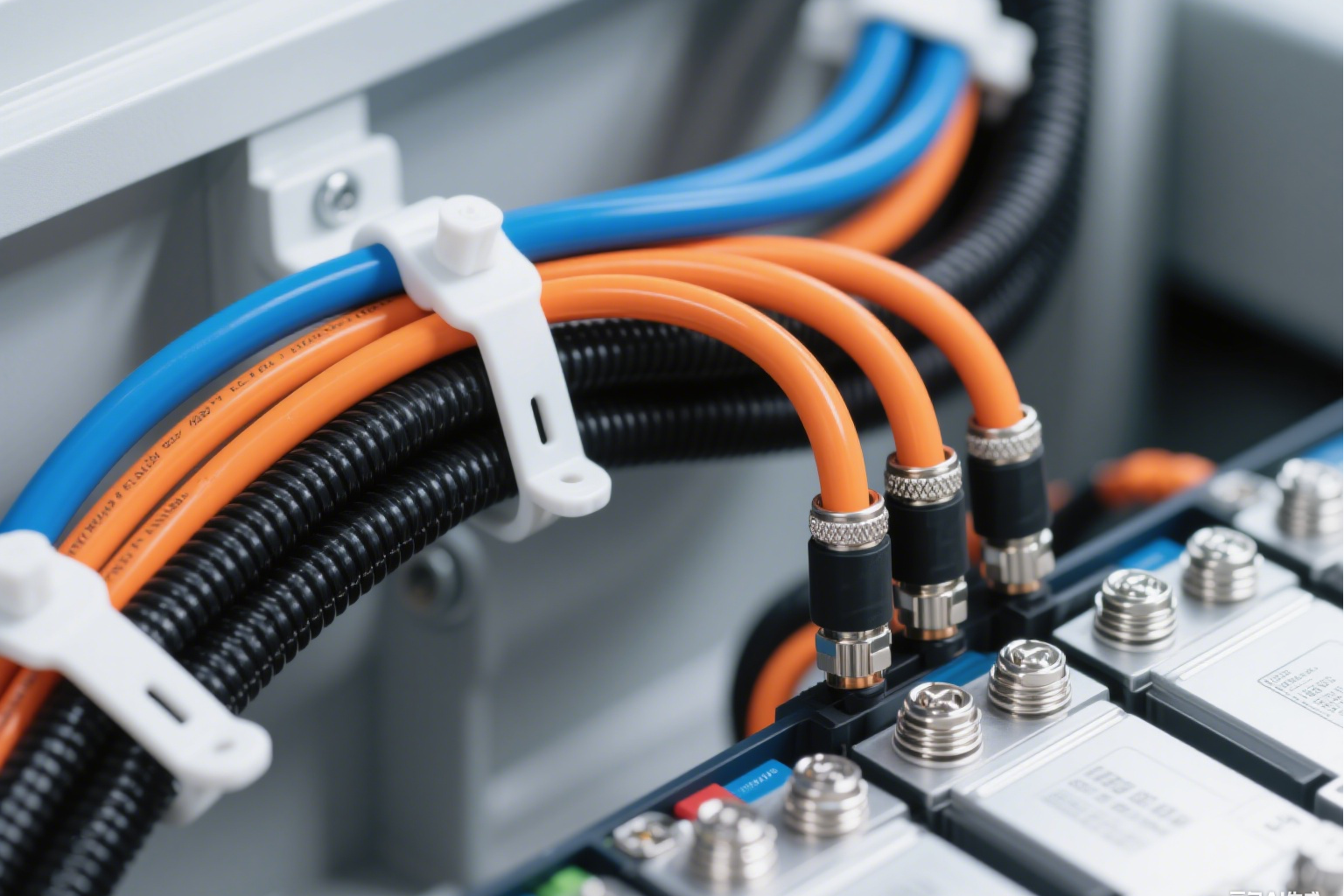

2. New energy vehicles and intelligent travel

The explosive growth of new energy vehicles has become the core driving force. Key components such as high-voltage battery packs, motor wiring harnesses, and charging interfaces require higher insulation, temperature resistance (such as 800V platforms requiring material temperature resistance ≥ 150 ℃), and lightweight characteristics for heat shrink tubing. The usage of bicycles has increased from 3-5 meters for traditional cars to 8-12 meters for electric vehicles, and it is expected that the market size in this field will exceed 5.8 billion yuan by 2030. In addition, the construction of charging piles and energy storage systems (such as the global charging pile market expected to exceed 60 billion US dollars by 2025) has also driven the demand for high-end products such as thin-walled heat shrink tubing for high-voltage direct current charging piles.

3. Communication and Consumer Electronics

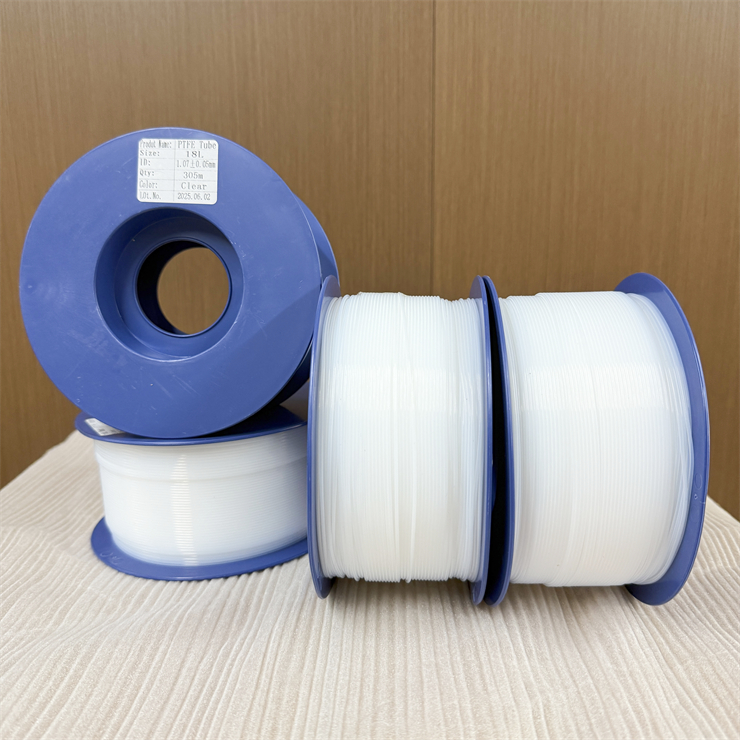

The construction of 5G base stations (planned by the Ministry of Industry and Information Technology to have over 6 million base stations by 2025) and fiber to the home projects are driving the demand in the communication field, with each base station using approximately 15-20 meters of heat shrink tubing. The trend of miniaturization in consumer electronics (such as micro heat shrink tubing with a diameter of less than 1mm) and the popularity of wearable devices have driven the rapid growth of ultra-thin and high flexibility products. In addition, the demand for low dielectric loss materials such as PTFE heat shrink tubing for high-density cabling in data centers continues to rise.

4. High end manufacturing and emerging fields

In the aerospace field, polyimide heat shrink tubing with high temperature resistance (260 ℃) and radiation resistance is used for engine wiring harness protection; In medical equipment, biocompatible heat shrink tubing (such as PTFE materials that comply with ISO 10993 standards) is used in precision instruments such as endoscopes and catheters. Emerging scenarios such as multi-layer composite heat shrink kits and flexible OLED display packaging materials for hydrogen energy storage and transportation pipelines are expected to create an average annual market of 1.2 billion yuan.

二、 Market size and growth forecast

1. Global and Chinese markets

The global heat shrink tubing market is showing a steady growth trend, with the Chinese market size approaching 15 billion yuan in 2024 and expected to exceed 30 billion yuan by 2030, with a compound annual growth rate of about 12%. In the international market, the top five manufacturers of polyolefin heat shrink tubing (TE Connectivity, 3M, etc.) account for about 60% of the global market share, while Chinese manufacturers such as Kehong Electronics and Apollo have cost advantages in the mid to low end market, with an annual export growth rate of over 9%.

2. Growth rate in segmented fields

New energy vehicles: Demand growth rate exceeds 15%, and high-voltage wire harness protection products have become the fastest-growing niche market.

Communication and consumer electronics: The upgrading of 5G base stations and intelligent terminals is driving demand, and it is expected that the proportion of the communication field will increase to 35% by 2030.

Industrial equipment: The expansion of applications in high temperature and high pressure environments (such as petrochemical pipeline sealing) is driving the demand for customized products, with an expected market share of 15% by 2030.

三、 Competitive Landscape and Regional Markets

1. Leading enterprises dominate, intensifying differentiated competition

International giants such as 3M and TE Connectivity dominate the high-end market (such as aerospace and medical), while domestic manufacturers Changyuan Group, Wore Materials, Kehong Electronics, and Aplro Industries lead the mid to low end market through large-scale production and cost-effectiveness advantages.

2. Regional market differentiation and opportunities

Eastern Coastal Region: With the electronic information industry cluster and manufacturing foundation, the East and South China regions occupy 55% of the national market share.

· Rise of Central and Western China: Benefiting from the "the Belt and Road" and the Western Development, power infrastructure and new energy projects have boosted the market share of central and western China from 10% to 25%.

Export growth: The construction of power infrastructure in Southeast Asia, the Middle East and other regions has driven China's heat shrink tubing exports, with an expected export value of 2.8 billion yuan by 2025, accounting for 15% of global trade volume.

四、 Technological development trends

1. High performance and functionality

High temperature and chemical resistance: For example, products with a high temperature resistance of 260 ℃ are used in aerospace applications, while PTFE heat shrink tubing is used in acid and alkali resistant scenarios in semiconductor equipment.

Environmental upgrade: The penetration rate of bio based polylactic acid heat shrink materials (biodegradable) and halogen-free flame retardant products has increased, and it is expected that the proportion of environmentally friendly materials will exceed 25% by 2030.

Intelligent and customized: Nano modification technology improves material insulation performance (volume resistivity increases by 3 orders of magnitude), and blockchain traceability system is applied to nuclear power grade products.

2. Production process innovation

The penetration of intelligent manufacturing is accelerating, with the coverage rate of MES systems in top enterprises increasing from 45% in 2025 to 80% in 2030, and the per capita output value increasing to 1.2 million yuan per year. Automated production lines and AI quality inspection systems reduce the defect rate to below 0.8ppm, while reducing reliance on manual labor.

五、 Challenges and Risks

1. Raw materials and cost pressures

The price of polyolefin resin (accounting for over 60% of the cost) is significantly affected by fluctuations in international oil prices. Although the domestic self-sufficiency rate has increased to 85%, high-end specialty plastics (such as fluoroplastics) still rely on imports. In addition, the EU REACH regulation's restrictions on flame retardants may increase technical barriers.

2. International trade and policy risks

The trade war provoked by the United States may affect export growth. The tightening of domestic environmental policies (such as VOC emission restrictions) has increased production costs.

3. Technological substitution and intensified competition

The application of alternative materials (such as silicone rubber sleeves) in some scenarios, as well as low price competition among small and medium-sized enterprises, may compress profit margins. The industry average gross profit margin will gradually decrease from 35% in 2025 to 30% in 2030.

六、 Future prospects

1. Market prospects

The heat shrink tubing industry will maintain an average annual compound growth rate of 10% -12%, and the global market size is expected to exceed 50 billion US dollars by 2030. As a core growth pole, China will contribute over 40% of the world's incremental demand driven by new energy, 5G, and high-end manufacturing.

2. Investment opportunities

High value-added fields: thin-walled heat shrink tubing for high-voltage DC charging piles (gross profit margin exceeding 40%), acid and alkali resistant series for semiconductor equipment.

Technological innovation direction: nano modified materials, hydrogen energy storage and transportation kits, biodegradable products.

Regional layout: Central and Western infrastructure and Southeast Asian export markets.

Strategic recommendations

Technology research and development: Increase investment in high-end materials (such as 300 ℃ resistant nano heat shrink tubing) and intelligent production.

Supply chain management: Establish strategic reserves of raw materials and layout overseas production bases (such as Vietnam and Mexico) to avoid trade risks.

Green transformation: Advance deployment of bio based materials and carbon footprint management, in compliance with ESG standards.

conclusion

The heat shrink tubing industry is in a critical period of transformation from traditional manufacturing to high-end and intelligent. The explosive demand for new energy, 5G, and high-end manufacturing has provided vast space for the industry, but technological upgrades, cost control, and global layout capabilities will become the core elements of enterprise competition. In the next five years, companies with material innovation capabilities, supply chain resilience, and international perspectives will dominate the market, while differentiated competition in segmented fields will further promote industry structure optimization.